7 Strategies For Student Loan Repayment

Repaying student loans is one of the biggest financial burdens for those of us who didn’t get a full ride to college. The average student loan debt in the US is $37,000 where experts estimate that the total student debt load is $1.4 TRILLION & climbing. While everyone’s financial situation is different there are consistent strategies that you can use to pay your student loans faster.

The following are SEVEN strategies I’ve utilized to pay down my student loan debt.

Pay Your Loans Individually

This first lesson is key to the strategy of repaying your student loans. I made the mistake making a $300 general loan payment for my first 4 loan payments back in 2017. I was very confused when I didn’t see a significant impact to the total balance of my loans. When you make a general loan payment you have ZERO control over how the funds are dispersed. If you have a combination of subsidized and unsubsidized, the general loan payment goes to all of them in small amounts. It is in your best interest to target specific loans when paying them back. Paying a general $300 payment will be spread amongst all your loans. This is not as impactful as paying $300 on one loan at a time.

You Must Be Aware & Consistent With Your Payments

Pay Off Unsubsidized loans IMMEDIATELY

For those who have federal student loans there are two types: subsidized and unsubsidized loans. The term unsubsidized means that the government is not subsidizing (paying) the interest on that loan. This also means that from the time the loan was originated (start date) interest has been accruing that very same day. Contrary to popular belief, you do not have to wait until the repayment period (5 – 6 months after graduation) to start repaying our loans. You should be proactive and pay your loans off now!

By paying off your unsubsidized loans first you reduce the long term impact the interest will have on your payments. If you were able to secure a job after college or even have funds saved from a lucrative internship, I highly recommend for you to use some of that to make routine payments on your unsubsidized loan.

Pay unsubsidized loans off before you enter the official repayment period. This allows you to better focus on eliminating them before the interest on subsidized loans begins. This way you are not stuck with all of your loans increasing significantly due to the interest.

Pay High Balance High Interest Loans First

As interest is a factor of magnitude and time, you want to target your highest interest and highest balance loans first. While tackling that smaller value loan first may seem easier, the higher interest you have on a high balance loan will inevitably increase at a faster rate than a loan with a lower balance.

For example if you compared a $4,000 loan with 3.5% interest versus a $6,000 loan with a 4.5% rate, it is in your best interest to pay off the $6000 loan first. The interest will add up faster and leaving you to pay more money over time the longer you wait. You would accumulate more interest leading to a higher overall payment in the long run.

$low & $teady Wins the Race

Use Extra Cash to Pay Student Loans

Did you compete a focus group this month or sell some old clothes? Is your Resume Refresh service generating extra income this month? The key to paying down student loan debt fast is keeping your eyes open to any surplus of cash that can be used to make a payment.

If you saved an extra $100 by not eating out this month that’s an extra $100 you should use to put towards your student loan!

Does your job give out a yearly bonus or profit share in December? It is okay to be selfish with that extra income and put it towards your student loans. Yes, you are working but you don’t have to play Santa Claus with that end of year bonus. I make it a point every December to use at least half of my bonus to put towards my student loans.

Stay At Home As Long As You Can!

While it does not seem ideal to move back home after college it is a sacrifice that can help you better manage your finances. If your job or career allows you to be close to home, take advantage of that opportunity. I have no shame in saying I live at home & I love my mom for it. While living at home my mom does not ask me for much. I pay a few bills with a total far less than an overpriced mini studio apartment and give her cash for groceries. This is nothing close to what some of my friends are paying for rent.

The money that I am saving from not living on my own is another reason I have been able to diligently make the payments on my student loans. Considering the fact that I was in graduate school (link) staying at home allowed me to pay for my Masters out of pocket further minimizing my dependence on student loans.

Refinance Your Loans for a Lower Interest Rate

This is a strategy I personally have not used but I know it can prove to be useful. The process of refinancing l=your loan is when a bank takes your outstanding loan balance + interest & offers you the option to consolidate your debts while offering a lower interest rate. This is advantageous if you have made significant improvements to your credit score and your credit is in a better place now than when you originally got the loan. By having a better credit you are eligible for better interest rate.

There are a multitude of banks that will allow you to refinance your loans for a lower rate. The advantage of this is that you can establish a lower interest across all of your loans. Depending on the year the loans originated they may vary in interest rate. By consolidating your loans it can help simplify the payment process. Having multiple loans with different originators can be confusing. By refinancing your loan for a lower rate you have more control over the repayment process.

Set Payoff Goals & Stick to Them

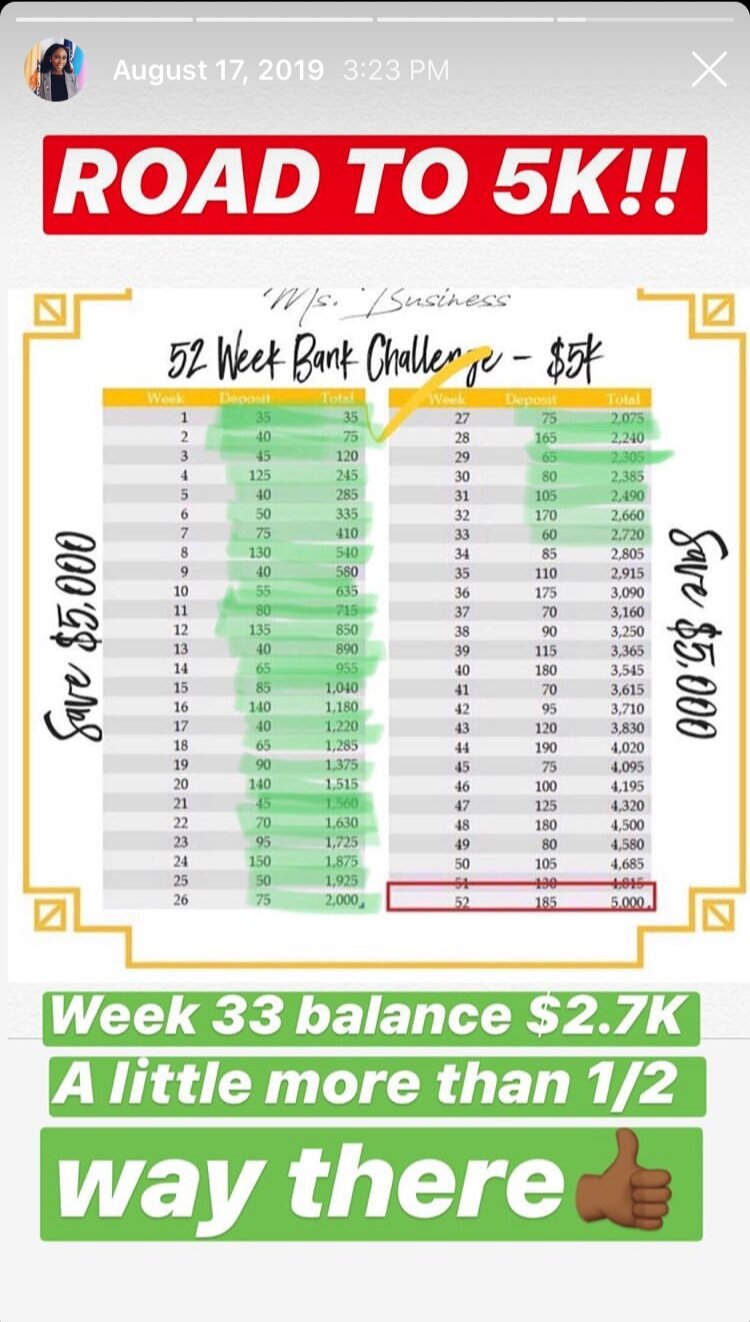

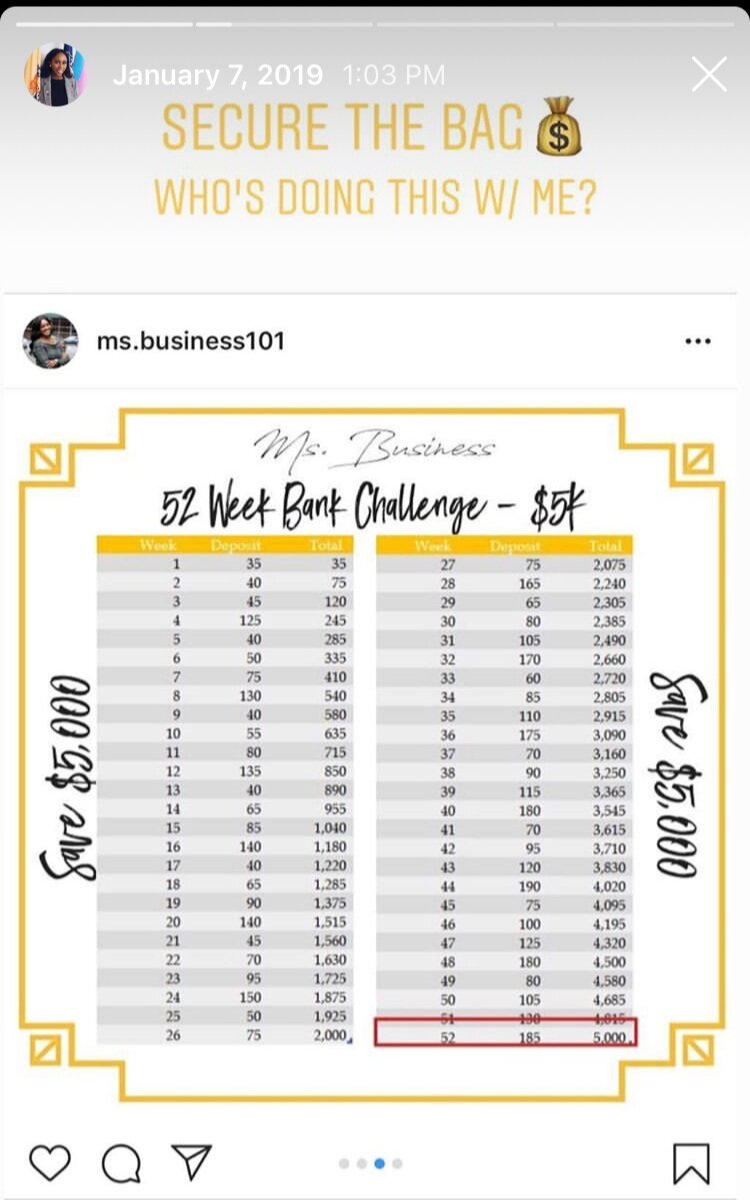

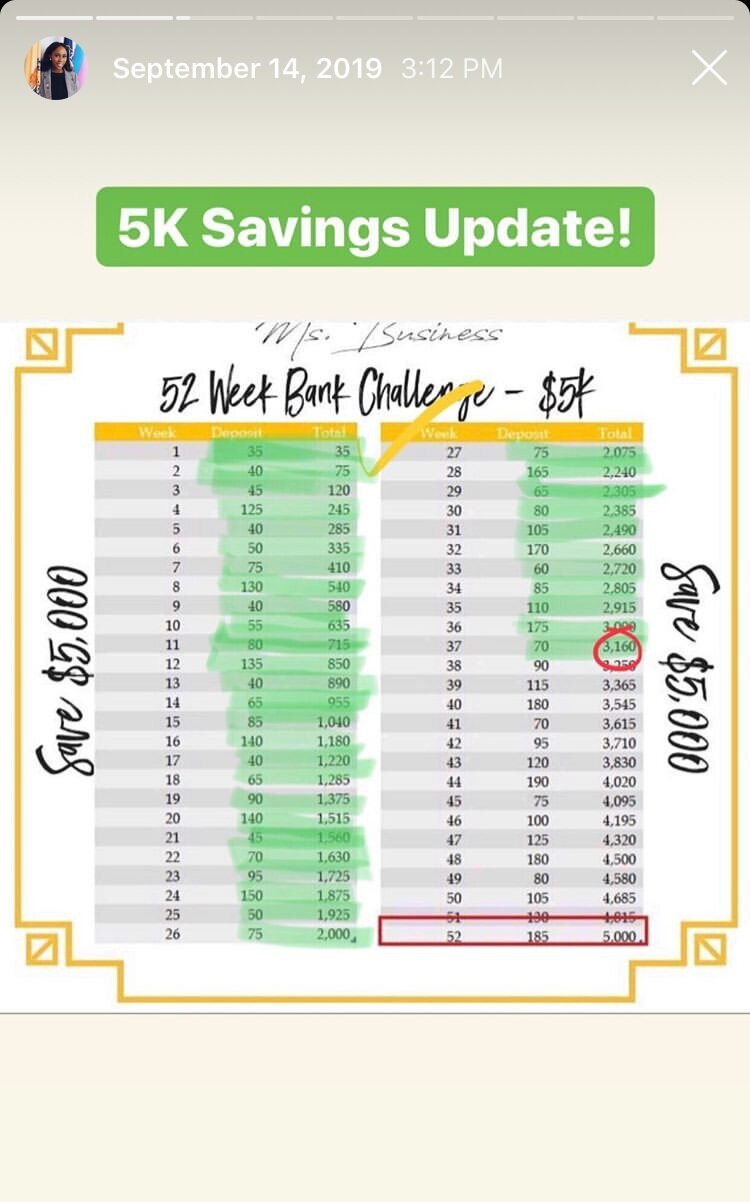

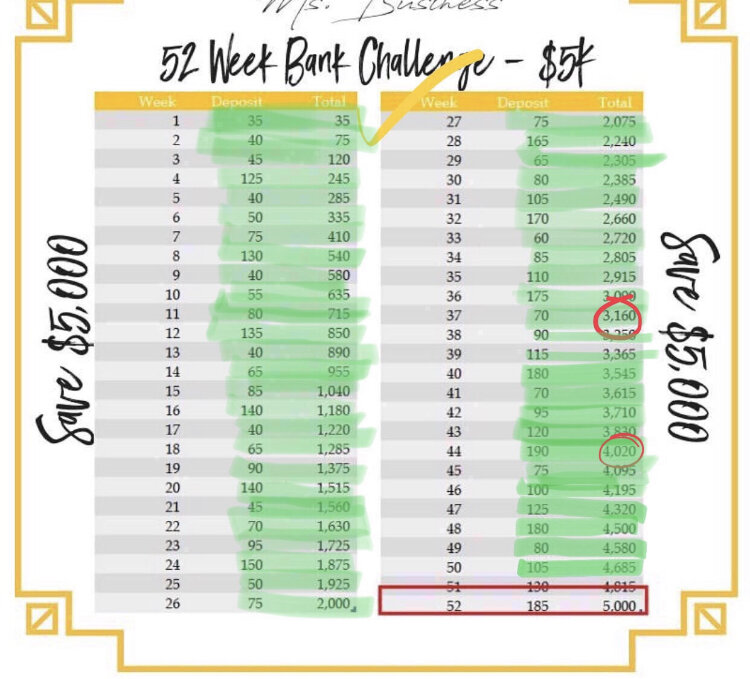

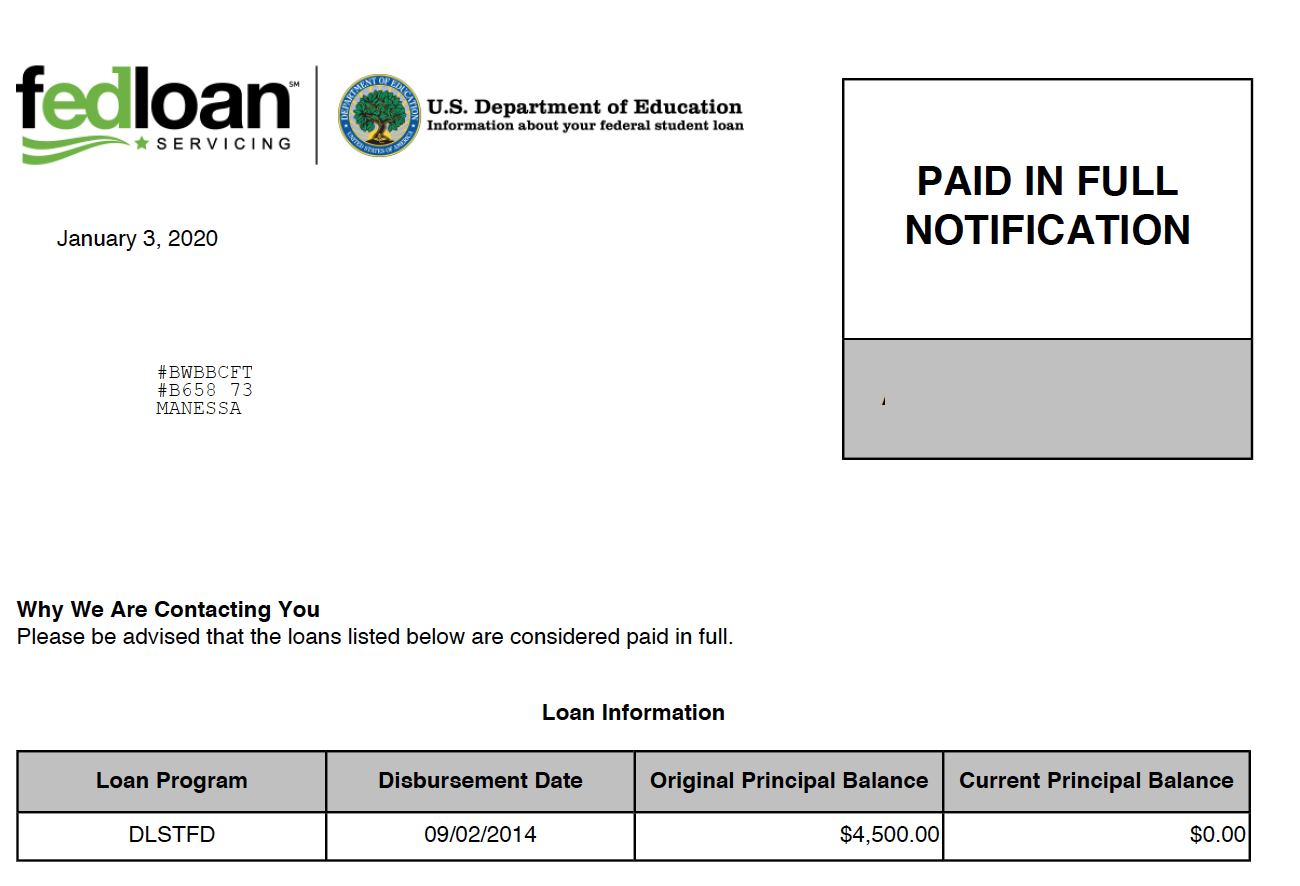

This past year I used a saving to $5K challenge to make a 1 time payment on my student loans. The challenge was spread throughout the 52 weeks in a year where every week a different amount was transferred to my savings with the goal of reaching $5K at the EOY. I have to thank Ms Business 101 for creating this because it has truly helped me be diligent and strategic with my saving goals. I am happy to announce that I was able to successfully complete the challenge! Though it seemed like a lot of money building up to the $5K was truly an achievement. I used the $5K I saved up to make a 1 time payment for the total balance of 1 of my loans that totaled $4,500!!!

Aside from that goal, I leveraged the use of multiple direct deposit accounts to have a portion of my check sent specifically to the account I use to pay off my loans. This way the funds I use to pay off my loans are already separate from my normal spending cash. By automating this process I don’t have to think about transferring the funds with the potential of me finding a different use for the money. This allows me to remain diligent and focused on my overall goal.